Introduction

Multi-family real estate investing is one of the most popular paths for building long-term wealth. With multiple units generating income, these properties can provide stability and strong returns. Here’s a step-by-step guide to get started.

Step 1: Understand the Appeal

Multi-family properties generate steady rental income and spread risk across multiple tenants. If one unit is vacant, the others still produce revenue.

Step 2: Assess Your Finances

Lenders evaluate your income, credit, and debt-to-income ratio before approving financing. Duplexes and fourplexes often qualify for residential loans. Before committing, know how much home you can afford.

Step 3: Research the Market

Location matters more than ever with rentals. Look for areas with strong job growth, schools, and rental demand. Flippers sometimes transition into this market — but beware of fix & flip mistakes.

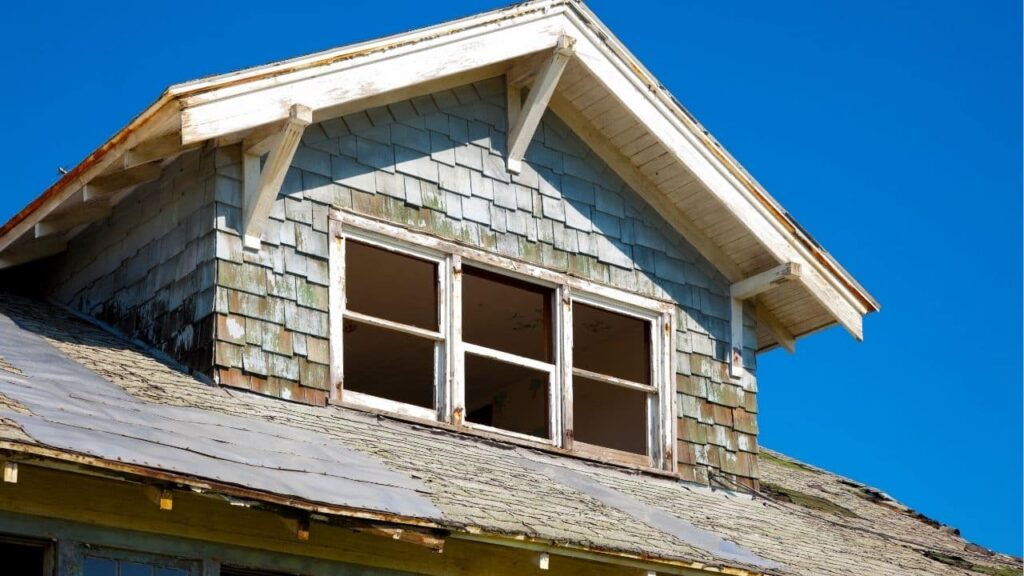

Step 4: Choose the Right Property

Start small with a duplex or triplex. Larger apartment buildings require more capital and management experience.

Step 5: Plan for Property Management

Tenants bring income but also require maintenance and oversight. Some investors self-manage, while others hire property managers. Long-term landlords often use passive income tactics to streamline cash flow.

Step 6: Think Long Term

Multi-family investing is not about quick profits. It’s about building equity, earning monthly income, and growing wealth over time.

Final Thoughts

Multi-family investing can be a smart strategy for steady income and long-term wealth. Start with how much home you can afford, avoid fix & flip mistakes, and consider adding passive income tactics to build a stronger portfolio.

Your questions, answered

Why invest in multi-family properties?

They generate steady rental income, spread risk across multiple units, and can be easier to finance than many think.

Do multi-family properties require more management?

Yes, but property managers can handle tenant relations, maintenance, and leasing.

Do multi-family properties require more management?

Yes, especially small duplexes or fourplexes, which are easier to manage and finance.